Our Program

Our 8-week program trains top startup founders to find, pitch and close with investors.

Our Program

Our 8-week program trains top startup founders to find, pitch and close with investors.

Learn how to fundraise in 8 weeks

Learn the building blocks of a rolling closing seed round. Work together virtually and have mastermind sessions with other like-minded founders round, leverage tactics, pitch performance, and mindset strategies. Raise The Round takes you step by step through the same methodology Iddo used to raise funding from over 100+ top angel investors and VCs.

Learn how to fundraise in 8 weeks

Learn and master the building blocks of a rolling closing seed round. Work together virtually and have mastermind sessions with other like-minded founders round, leverage tactics, pitch performance, and mindset strategies. Raise The Round takes you step by step through the same methodology Iddo used to raise funding from over 100+ top angel investors and VCs.

1. POWERFUL PITCH DECK

General Guidelines of a Powerful Pitch Deck

Guidelines and structure for creating a powerful deck with all the ingredients investors are looking for

Intro Slide

The intro slide creates the first impression of your startup. It should already be on the screen when investors get into the room and is there during the initial chit-chat before you dive into your deck.

Market Slide

Your target market needs to be huge, rapidly growing, and well defined so that the company who will lead it will definitely be a unicorn. 🦄 This unit will guide you step by step on defining and presenting your target market to investors.

Problem Slide

You want to focus on one BIG problem your startup plans to solve—a problem that is urgent, extremely expensive, critical, affecting many people, frequent, pervasive, rapidly escalating or mandatory to solve due to new regulations

Solution Slide

It is crucial for investors to understand your solution and its advantages. They should be able to repeat it to share it with others. Can YOU describe your solution and the advantages in a few simple sentences? Sounds easy, right? Not really. 90% of the startups we meet can’t do it.

Product Slide

If the solution slide is all about WHAT you do, the product slide shows HOW you do it. It tells the story of how the product works and its unique features. As much as your product is complex, this unit will show you how to get it all in one slide.

Business Model Slide

How much do you charge your customers? What is your unit economics? What does your sales cycle look like? You need to know this, even before you launch your product. It is crucial for founders to deeply understand the business model based on testing data and research.

Traction

"Get back to us when you have more traction." Have you heard that one before? We will take you through 7 types of traction you can have before even launching a product including 5 traction types for the pre-revenue stage.

Go-To-Market Slide

"You say you will get to $10M of sales in 2 years. How will you get there?" Your go-to-market strategy slide should answer that. It is an efficient and well-thought-out plan to quickly and easily grow your business.

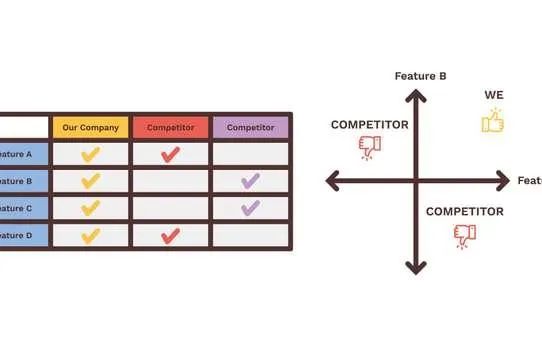

Competitive Landscape & Unfair Advantage Slide

Some investors say this is one of THE slides they base their decision to invest on. Yet, many founders do not give it the attention it deserves. In this unit you will visually map out your market, clearly showing how and why you will be the winner.

Team Slide

Many investors know ideas change; early-stage startups often pivot. What they really invest in is the team. They are looking for an A+ high-performing team. What is the best way to show it? How do you provide enough signals that your team has the potential to become the market leader

Offer Slide

Yes, investors want to know the terms of your offer, how you will use the funds and what you plan to achieve with them. This unit will show you how to do it while having momentum and a respectful sense of urgency.

Outro Slide

A well-defined strong vision leaves investors with a WOW feeling that makes them want to join it by investing in your startup.

2. ROUND PREPARATION

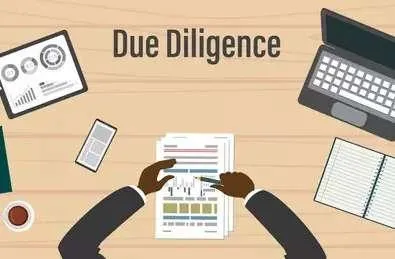

Due Diligence Folder

A repository of all necessary documents investors need to sign the deal

Financial Modeling

The ability to show a data-driven plan to grow your business, know your runway and your revenue forecast and be able to show and answer 'what if' questions about your business assumptions and projections.

IP & Patent Deck

A clear comprehensive deck to present your IP and patents

Product Roadmap

Share your product development plan up to a fully mature product. What are the main product features you plan to add?

Product Demo

If a picture is worth a thousand words, a product demo is worth a thousand pictures. Make sure to have a good one!

Technology Outline

Presenting investors with your technology structure and depth will help them understand your defensibility, barrier-to-entry, and first-mover advantage.

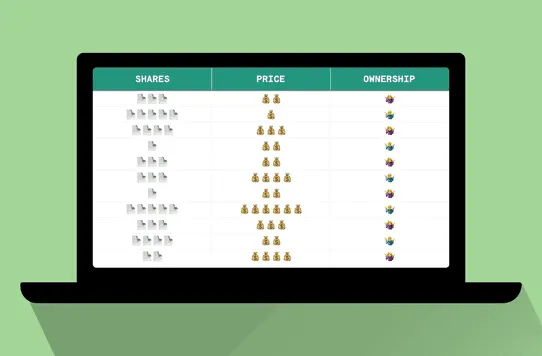

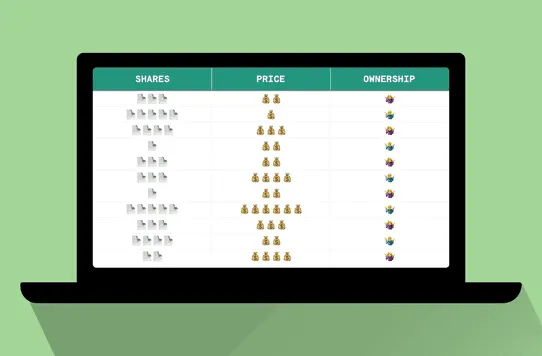

Determine Cap & Discount

You need to learn how to price the round, i.e., how to set up your SAFE cap and discount

Understanding The VC Mindset

What’s important to them, how they make decisions

Founder-Friendly Terms

How you deal with your own terms is a critical signal to investors on how you manage the business and their money. You want to make sure they are set correctly and that you avoid the top 5 fatal mistakes when creating agreements.

Understanding SAFE

Understanding SAFE by knowing how SAFE really works and its long term impact in different scenarios

Top Legal Terms a Startup Founder Must Know

Avoid putting yourself in a situation where the other side (the investors) knows the rules of the game inside out while you have never played before and do not understand the rules.

Company Descriptor & Elevator Pitch

It is fundamental for a founder to be able to clearly describe in a few words what their startup is doing. It is key for opening doors.

Strong Online Presence for Founders

Investors will Google you. What will they find?

3. MANAGING THE ROUND

Build and Manage a Rich Investor Pipeline

Identify a large list of investors that are actively investing in your space, stage, and physical location

Emails That Get You into a Meeting

When investors are reading your email, they have one main question in mind – ‘Do I want to meet them?’ Craft a powerful email that has all the information needed to make that decision.

Keeping Yourself Emotionally Fit During The Round

Get ready to hear ‘no’ many times. Some investors will just ghost you. There are a lot of ups and downs during the round. Make sure you have the right tools to get you through it.

4. MEETING INVESTORS

Meeting Management

Many founders go to meet investors, do a hard sell for the entire time, and afterward, wait for the investors to get back to them. There is a much better way to manage a meeting with investors that dramatically increases your chances of raising capital from them.

Pitch Like a Pro

Research shows that what you say is accountable for less than 20% of what you communicate, the rest is how you deliver the message including your body language and facial expressions. Make sure to get pitch performance training

Powerful communication with investors

It’s important to know how to answer questions, create a fruitful free flow conversation, be concise, express agreement, use silence or deal with objections.

How to Present Your Offer

Many founders feel uneasy presenting their offer. Learn top practices on how to present your offer with confidence and a respectful natural sense of urgency.

How To Look & Sound Great on Zoom

Since the start of the pandemic, many founders found themselves raising money from investors on Zoom without ever meeting face to face. How you look and sound on Zoom has a strong effect on getting a YES.

A Closing Formula

Like any sales process, a great pitch by itself is not enough; you need to have an effective closing process in place.

1. POWERFUL PITCH DECK

General Guidelines of a Powerful Pitch Deck

Guidelines and structure for creating a powerful deck with all the ingredients investors are looking for

Intro Slide

The intro slide creates the first impression of your startup. It should already be on the screen when investors get into the room and is there during the initial chit-chat before you dive into your deck.

Market Slide

Your target market needs to be huge, rapidly growing, and well defined so that the company who will lead it will definitely be a unicorn. 🦄 This unit will guide you step by step on defining and presenting your target market to investors.

Problem Slide

You want to focus on one BIG problem your startup plans to solve—a problem that is urgent, extremely expensive, critical, affecting many people, frequent, pervasive, rapidly escalating or mandatory to solve due to new regulations

Solution Slide

It is crucial for investors to understand your solution and its advantages. They should be able to repeat it to share it with others. Can YOU describe your solution and the advantages in a few simple sentences? Sounds easy, right? Not really. 90% of the startups we meet can’t do it.

Product Slide

If the solution slide is all about WHAT you do, the product slide shows HOW you do it. It tells the story of how the product works and its unique features. As much as your product is complex, this unit will show you how to get it all in one slide.

Business Model Slide

How much do you charge your customers? What is your unit economics? What does your sales cycle look like? You need to know this, even before you launch your product. It is crucial for founders to deeply understand the business model based on testing data and research.

Traction

"Get back to us when you have more traction." Have you heard that one before? We will take you through 7 types of traction you can have before even launching a product including 5 traction types for the pre-revenue stage.

Go-To-Market Slide

"You say you will get to $10M of sales in 2 years. How will you get there?" Your go-to-market strategy slide should answer that. It is an efficient and well-thought-out plan to quickly and easily grow your business.

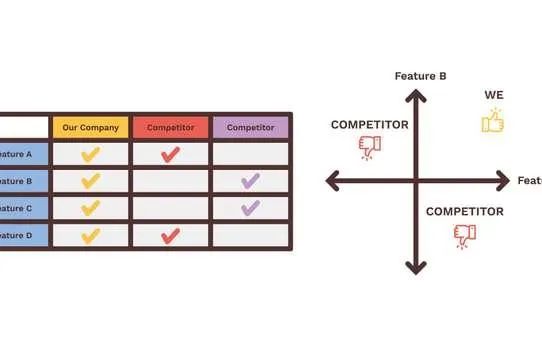

Competitive Landscape & Unfair Advantage Slide

Some investors say this is one of THE slides they base their decision to invest on. Yet, many founders do not give it the attention it deserves. In this unit you will visually map out your market, clearly showing how and why you will be the winner.

Team Slide

Many investors know ideas change; early-stage startups often pivot. What they really invest in is the team. They are looking for an A+ high-performing team. What is the best way to show it? How do you provide enough signals that your team has the potential to become the market leader

Offer Slide

Yes, investors want to know the terms of your offer, how you will use the funds and what you plan to achieve with them. This unit will show you how to do it while having momentum and a respectful sense of urgency.

Outro Slide

A well-defined strong vision leaves investors with a WOW feeling that makes them want to join it by investing in your startup.

2. ROUND PREPARATION

Due Diligence Folder

A repository of all necessary documents investors need to sign the deal

Financial Modeling

The ability to show a data-driven plan to grow your business, know your runway and your revenue forecast and be able to show and answer 'what if' questions about your business assumptions and projections.

IP & Patent Deck

A clear comprehensive deck to present your IP and patents

Product Roadmap

Share your product development plan up to a fully mature product. What are the main product features you plan to add?

Product Demo

If a picture is worth a thousand words, a product demo is worth a thousand pictures. Make sure to have a good one!

Technology Outline

Presenting investors with your technology structure and depth will help them understand your defensibility, barrier-to-entry, and first-mover advantage.

Determine Cap & Discount

You need to learn how to price the round, i.e., how to set up your SAFE cap and discount.

Understanding The VC Mindset

What’s important to them, how they make decisions

Founder-Friendly Terms

How you deal with your own terms is a critical signal to investors on how you manage the business and their money. You want to make sure they are set correctly and that you avoid the top 5 fatal mistakes when creating agreements.

Understanding SAFE

Understanding SAFE by knowing how SAFE really works and its long term impact in different scenarios

Top Legal Terms a Startup Founder Must Know

Avoid putting yourself in a situation where the other side (the investors) knows the rules of the game inside out while you have never played before and do not understand the rules.

Company Descriptor & Elevator Pitch

It is fundamental for a founder to be able to clearly describe in a few words what their startup is doing. It is key for opening doors.

Strong Online Presence for Founders

Investors will Google you. What will they find?

3. MANAGING THE ROUND

Build and Manage a Rich Investor Pipeline

Identify a large list of investors that are actively investing in your space, stage, and physical location

Emails That Get You into a Meeting

When investors are reading your email, they have one main question in mind – ‘Do I want to meet them?’ Craft a powerful email that has all the information needed to make that decision.

Keeping Yourself Emotionally Fit During The Round

Get ready to hear ‘no’ many times. Some investors will just ghost you. There are a lot of ups and downs during the round. Make sure you have the right tools to get you through it.

4. MEETING INVESTORS

Meeting Management

Many founders go to meet investors, do a hard sell for the entire time, and afterward, wait for the investors to get back to them. There is a much better way to manage a meeting with investors that dramatically increases your chances of raising capital from them.

Pitch Like a Pro

Research shows that what you say is accountable for less than 20% of what you communicate, the rest is how you deliver the message including your body language and facial expressions. Make sure to get pitch performance training

Powerful communication with investors

It’s important to know how to answer questions, create a fruitful free flow conversation, be concise, express agreement, use silence or deal with objections.

How to Present Your Offer

Many founders feel uneasy presenting their offer. Learn top practices on how to present your offer with confidence and a respectful natural sense of urgency.

How To Look & Sound Great on Zoom

Since the start of the pandemic, many founders found themselves raising money from investors on Zoom without ever meeting face to face. How you look and sound on Zoom has a strong effect on getting a YES.

A Closing Formula

Like any sales process, a great pitch by itself is not enough; you need to have an effective closing process in place.

Save Thousands on Startup Tools

Join Raise The Round and get exclusive access to discounts on useful startup tools.

Save Thousands on Startup Tools

Join Raise The Round and get exclusive access to discounts on useful startup tools.

Need support with your round?

Book a call with us.

We’ll assess the situation and see how we can work together.

Need support with your round?

Book a call with us.

We’ll assess the situation and see how we can work together.

FOLLOW US

COMPANY

CUSTOMER CARE

LEGAL

Copyright 2025. Raise The Round . All Rights Reserved.

FOLLOW US

COMPANY

CUSTOMER CARE

LEGAL

Copyright 2025. Raise The Round . All Rights Reserved.